Key Points:

- Governor Jared Polis and Colorado legislative leaders have unveiled a historic plan aimed at reducing property taxes for homeowners and businesses, potentially saving taxpayers an additional $1 billion annually.

- The proposal, to be voted on in November, would offer immediate and long-term relief, including a significant reduction in residential assessment rate and taxable value for primary residences in 2023 and 2024.

- The plan takes measures to protect funding for vital local services and offers increased relief for seniors receiving the Homestead Exemption, showcasing a balanced approach to property tax relief.

Historic Property Tax Relief Proposal

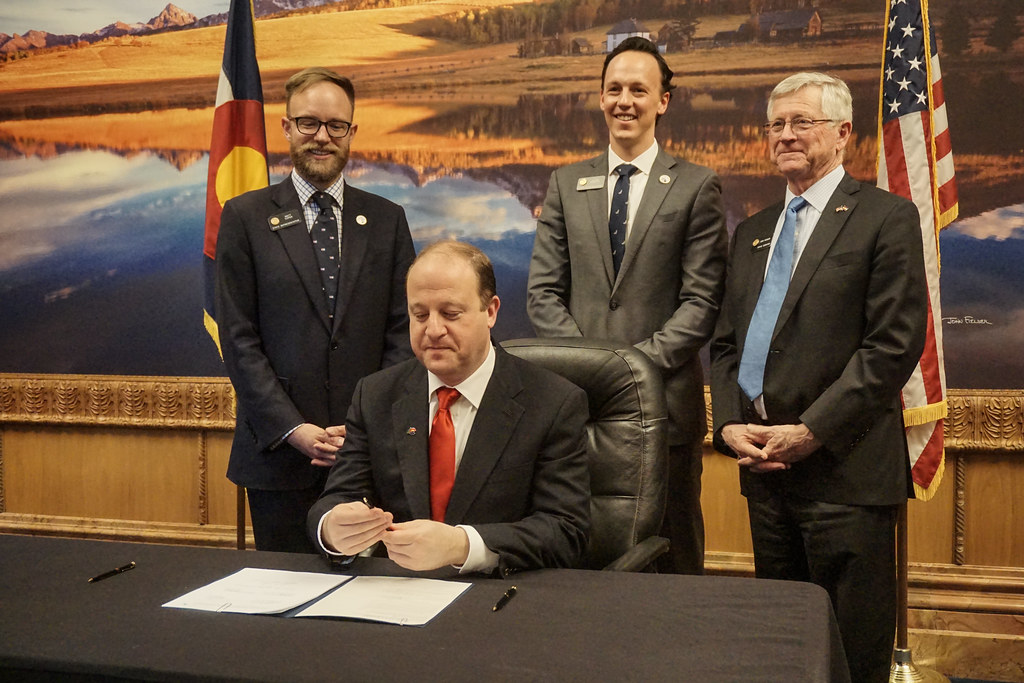

DENVER, CO – Governor Jared Polis and Colorado legislative leaders announced a groundbreaking plan aimed at reducing property taxes for homeowners and businesses across the state, while also securing the funding for essential local services such as public education, fire and water districts, and hospital districts.

The Key Proponents: Voices from the Administration and Legislature

Building on over $1 billion in historic property tax relief already provided by the Polis administration, in partnership with the legislature, this proposal is set to offer immediate relief and create a long-term solution to prevent rising home values from escalating property taxes. It will also set boundaries to safeguard homeowners and businesses from abrupt, steep hikes in their property taxes. The proposal is projected to save Colorado taxpayers an additional $1 billion annually, which will keep Colorado's property taxes among the lowest in the nation.

Governor Polis said, “This proposal will cut the average homeowners' tax increase in half and deliver long-term relief to protect people, especially seniors on a fixed income, from being priced out of their homes.”

Impact on Average Homeowners and Businesses

The measure, which will be voted on by Coloradans this November, promises to deliver major long-term reductions to property tax rates and offer immediate savings on property taxes this year. If enacted, it is estimated to save the average homeowner $1,264 over the next two years and offer between $900 million and $1.6 billion in annual property tax relief for homeowners and businesses in Colorado.

Several key property tax relief and protections proposed in this plan include: reducing the residential assessment rate from 7.15% to 6.7% in 2023 and 2024 for primary residences (excluding second homes and investment properties); decreasing the taxable value of residences by $40,000 in 2023 and 2024 for primary residences; and capping the growth in district property tax collections excluding school districts at inflation.

The plan also features protective measures to ensure vital services are not negatively impacted by these reductions. It proposes to backfill revenue to public education, fire districts, water districts, ambulance and hospital districts in slower growing areas of the state using a portion of the state TABOR surplus.

Additionally, seniors who currently receive the Homestead Exemption will see a larger reduction of $140,000 and will continue to receive this reduction if they move. This move is aimed at protecting seniors on fixed incomes from property tax increases that could potentially price them out of their homes.

Previous Property Tax Relief Efforts

Governor Polis, along with the legislature, has already delivered significant property tax relief, including a package last year that provided $700 million to lower property tax rates and reduced rate increases over two years. In 2021, they created the Property Tax Deferral Program, which allows Coloradans to defer a portion of their property tax if they increase over 4%. This deferral opportunity was expanded from previously only being offered to seniors and veterans to now be available to all Coloradans.

Looking Forward: The November Vote

The proposal has been praised by various legislative leaders for its thoughtful and balanced approach to property tax relief while ensuring vital local services are protected. Coloradans are eagerly awaiting the November vote to decide the future of this transformative property tax relief package.

Read the full press release here.

.png)

.png?width=170&height=64&name=Logo%20320x120(2).png)